NEW

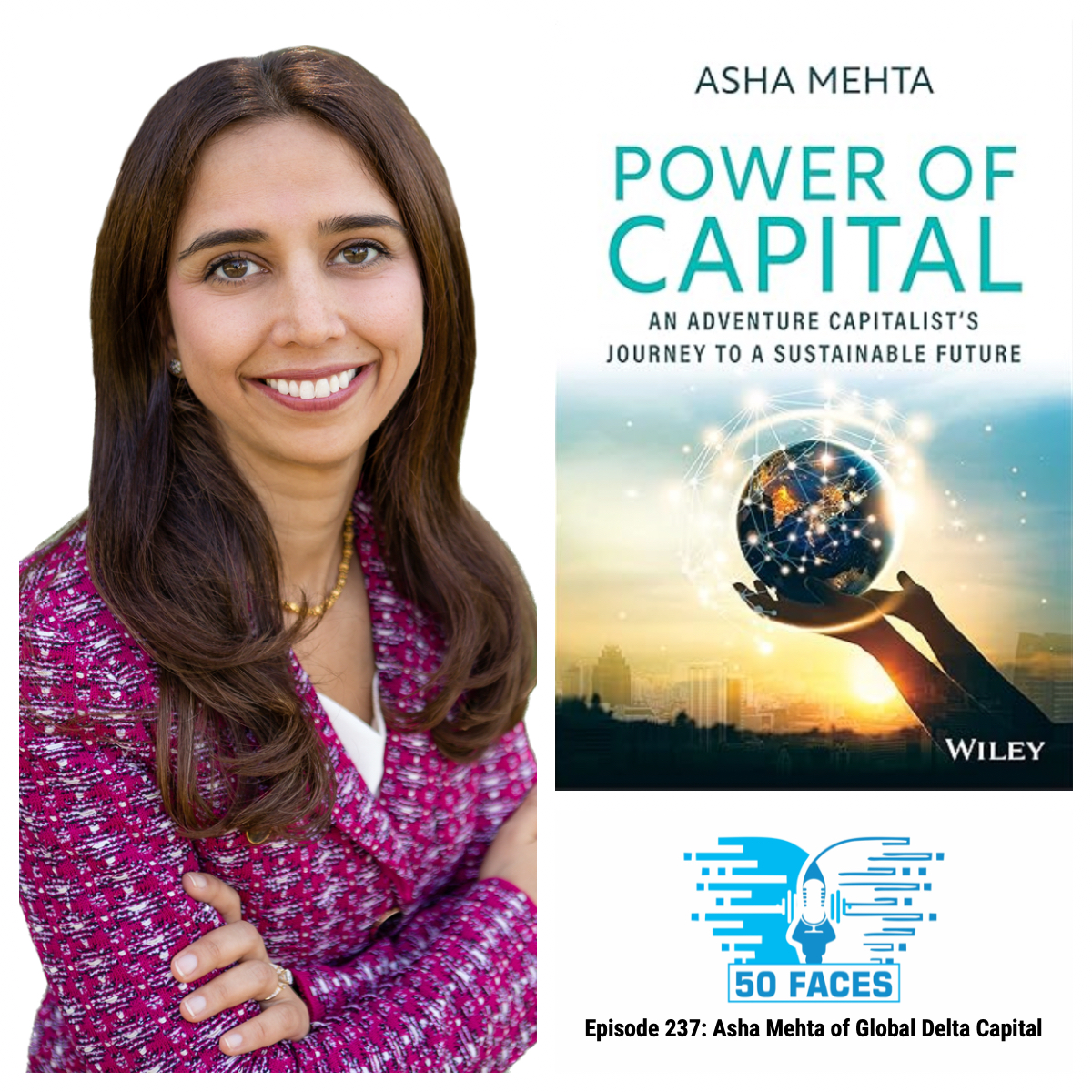

NEW Asha Mehta is Managing Partner and Chief Investment Officer at Global Delta Capital, where she has a thematic focus on Emerging and Frontier Markets as well as Sustainability Investing. She was previously Lead Portfolio Manager and Director of Responsible Investing at Acadian Asset Management and prior to that an investment banker. She has traveled to over 80 countries and lived in six, and recently released a book, The Power of Capital: An Adventure Capitalist’s Journey to a Sustainable Future.

Our conversation starts with her upbringing and her parents’ immigration story, and winds its way through Asha‘s college years and her early interest in biological sciences. A setback to funding of a vaccine distribution project in India, led to her finding work experience in Microfinance, and there a belief in impact and the power of capital was born.

Asha then takes on a world tour, first through an investor’s lens – we hear about her travels around the world and the areas where technology is enabling leapfrogging of existing infrastructure and breakthroughs that improve living standards and ultimately create impact. We travel from Nigeria to Saudi Arabia, from Tunisia to Cambodia, and apply also the lens of sustainability, examining what meaningful ESG data looks like and how it can be used to fashion investment decisions.

We spend some time speaking about Asha‘s book, The Power of Capital, which is written in the spirit of a true Adventure Capitalist, and the labor of love that that entailed. Another labor of love was Asha‘s founding of her own firm Global Delta Capital, and we discuss the “adventure” of entrepreneurship and capital raising.

You can find the book here: Link to powerofcapital.com and Powe

As final words of wisdom, Asha encourages listeners to be the change they wish to see in the world. Similarly, to learn to work through change and even embrace it.

Series 1 of 2024 is supported by Apollo Global Management, a leading provider of alternative asset management and retirement services solutions. Apollo seeks to provide clients excess return at every point along the risk-reward spectrum and is focused on empowering retirees, building and financing stronger businesses and driving a more sustainable future.